Seller’s Guide

This guide is an introduction to selling property on the Costa del Sol. Regulations vary across Spain, so we recommend you always check with local authorities or consult a lawyer.

Get the price right

Use an agent to help set a realistic price for your property. If you price too high, your property can be on the market for months or even years and will often sell for less than could have been achieved had it been marketed at the correct price from the start.

If you own a property in any of the areas we cover and are thinking about selling, ask us for a free appraisal.

Get your paperwork in order

To sell your property, you’ll need some basic documentation. This includes:

- A recent nota simple from the Property Registry.

- A receipt of payment of IBI (property tax).

- A receipt for payment of basura (refuse collection).

- If your property is in a community, a copy of your monthly community fees.

- Energy performance certificate (Certificado de Eficiencia Energética/CEE).

We can help you with all the paperwork needed, including the Property Registry and CEE inspections.

Know your selling costs

Sellers have to pay taxes and costs, depending on:

- Period of ownership.

- Increases in value over the period.

- Your tax resident status.

- Income during the year you sell.

Municipal capital gains tax (Plusvalía)

This is levied by the local Town Council on increases in the value of land on which your property stands. It is calculated on the rise in rateable value over the period of ownership. The longer you own a property, the more you pay. But, based on a recent ruling by Spain’s Constitutional Court, if you make no gain, you should no longer be liable for tax. You have 30 days from completion to pay any taxes due. For non-residents, the buyer will retain tax due, as he or she will be liable in case of non-payment.

Income tax (Impuesto sobre la Renta)

This is levied by the Spanish Tax Agency on any income earned during a fiscal year. It is calculated on the difference between purchase and sale prices, and levied according to your tax residency status. Residents pay tax on capital gains at the following rates:

| Capital Gain | Tax |

|---|---|

| 0 – 6,000€ gain | 19% |

| 6.000€ – 50.000€ | 21% |

| 50.000€+ | 23% |

| Residents over 65 who sell a primary residence are exempt from tax. | 0% |

| Residents under 65 who sell a primary residence and reinvest in another Spanish property as a primary residence within three years are exempt from tax on the amount reinvested. | 0% |

Non-residents pay tax at a fixed rate of 19%, except those who purchased a property between 12.05.12 and 31.12.12, who pay tax at 9.5%.

When buying from a non-resident seller, buyers are required to retain 3% of the sale price to pay to the Spanish Tax Agency on the seller’s behalf.

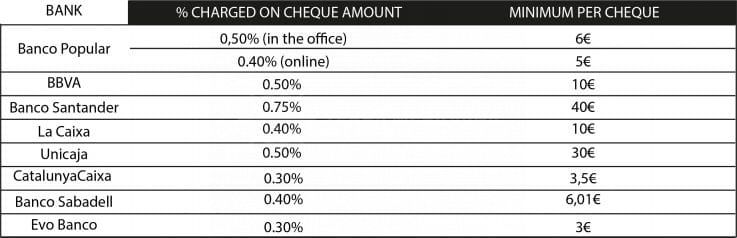

Mortgage cancellation fees

If your property is mortgaged and the loan will be paid off on sale, any costs are normally paid by the seller.

Other costs

The buyer normally pays all other costs, but sellers should stipulate in the private purchase contract that the buyer pays notary fees or, if not, you will be liable for 80% of these costs.

Sellers should inform the Cadastre (Catastro) and, if applicable, the community that they have sold a property, so that they are no longer liable for any taxes or fees.